ACE Cash Express Review

Hey, I’m Randy Murrie from Ready Payday Loans. When you’re searching for fast financial help, ACE Cash Express is a name you’ll likely come across. They’ve been offering cash advances and other money solutions for years, making them a go-to for many people who need short-term loans quickly.

In this review, I’ll take a look at what payday loan services have to offer—from the different types of loans to how you can apply. Whether you’re new to payday loans or just comparing options, I’ll break it all down in a way that’s simple and clear.

Who is ACE Cash Express?

It is a financial service provider that helps people access quick funds through a variety of loan options. They operate both online and in physical locations across many U.S. states.

Highlights:

- In-person and online services

- Speedy application process

- Same-day cash delivery

- Open to applicants with less-than-perfect credit

- Offers financial products like prepaid cards and check cashing

Loan Options from ACE Cash Express

Payday Loans

Short-term loans are designed to cover expenses until your next paycheck.

- Amount: $100 to $1,500 (depending on state)

- Repayment: Typically due on your next payday

- Disbursement: Often the same day

Installment Loans

Spread your repayment over several months.

- Amount: $500 to $5,000

- Payment Schedule: Monthly installments

Title Loans

Use your car title as loan security.

- Amount: Based on your car’s value

- Requirement: Must own your car outright

Additional Services

- Check Cashing

- Prepaid Cards

- Money Transfers

How to Apply for a Loan

Applying is easy and fast. Here’s how:

- Start Online or Visit a Store

- Provide Documents: ID, proof of income, and bank details

- Get a Decision: Often in minutes

- Receive Your Funds: Many customers receive their money the same day

Application Timeline

| Step | Estimated Time |

| Application | 5–10 minutes |

| Approval Decision | A few minutes |

| Funds Sent | Same day or next day |

Basic Requirements

To qualify, you’ll generally need:

- To be 18 or older

- A steady income

- A checking account

- A valid government-issued ID

Where You Can Find ACE Cash Express

They have a presence both online and in many brick-and-mortar locations, though availability varies by state.

Bar Chart: Loan Availability by Channel

What Customers Say

“Very quick process! I had the money I needed before the day ended.” – Michael S.

“The staff at the store made everything easy to understand. Friendly service!” – Brianna T.

Safe and Reliable

ACE Cash Express is a legitimate lender. They follow state regulations and protect your personal data with modern security features.

Why Choose ACE Cash Express?

- Range of loan types to choose from

- Face-to-face customer service options

- Simple and fast funding process

- Accommodates various credit backgrounds

Comparison Chart: ACE Cash Express vs. Ready Payday Loans

| Feature | ACE Cash Express | Ready Payday Loans |

| Online Application | Yes | Yes |

| In-Store Services | Yes | No |

| Same-Day Funding | Yes | Yes |

| Accepts Poor Credit | Yes | Yes |

| Personalized Support | Limited | Yes |

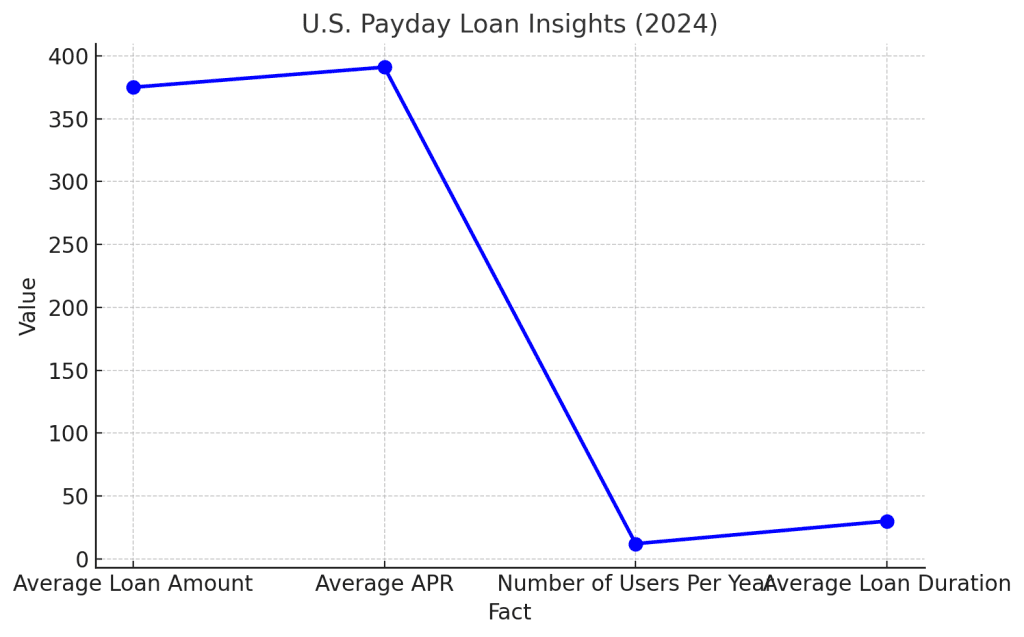

U.S. Payday Loan Insights (2024)

| Fact | Number |

| Average Loan Amount | $375 |

| Average APR | 391% |

| Number of Users Per Year | 12 million |

| Average Loan Duration | 14–30 days |

Source: Pew Research Center, Experian, CFPB

Wrapping It Up

If you need fast and flexible funding, ACE Cash Express could be a great option to consider. They’ve got multiple loan types, same-day disbursement, and a long-standing reputation in the financial services industry.

Make sure to review your loan terms carefully, and only borrow what you can repay.

Explore Ready Payday Loans

Looking for something 100% online with quick approvals and extra attention to your needs? Check out Ready Payday Loans. We’re all about giving you a smooth, no-hassle experience every step of the way.

Let us help you get back on track—apply today!