1800LoanStore Review

1800LoanStore is an online lending platform that connects borrowers with a network of lenders offering various loan products, primarily focusing on auto title loans. Operating nationwide, the company aims to provide quick financial solutions for individuals needing immediate cash, regardless of their credit history.

1800LoanStore Loan Products and Services

Auto Title Loans

The primary service offered by 1800LoanStore is auto title loans. These are secured loans where borrowers use their vehicle’s title as collateral. Key features include:

- Loan Amounts: Determined based on the vehicle’s value.

- Repayment Terms: Flexible terms tailored to the borrower’s needs.

- Credit Requirements: No credit check is typically required, making it accessible for those with poor credit.

- Vehicle Use: Borrowers can continue using their vehicle during the loan term.

Personal Loans

For individuals whose vehicles may not qualify for a title loan, 1800LoanStore also facilitates personal loans. These unsecured loans are based on the borrower’s creditworthiness and ability to repay.

1800LoanStore Application Process

The application process is straightforward and entirely online:

- Online Form: Applicants fill out a form with personal and vehicle information.

- Loan Matching: 1800LoanStore connects applicants with suitable lenders from their network.

- Approval and Funding: Once approved, funds can be disbursed quickly, sometimes within the same day.

Pros and Cons of 1800LoanStore

Pros

- Quick Access to Funds: Fast processing times for urgent financial needs.

- No Credit Check for Title Loans: Accessible to individuals with poor credit histories.

- Continued Vehicle Use: Borrowers retain the ability to use their vehicle.

- Flexible Repayment Terms: Customized plans to fit individual financial situations.

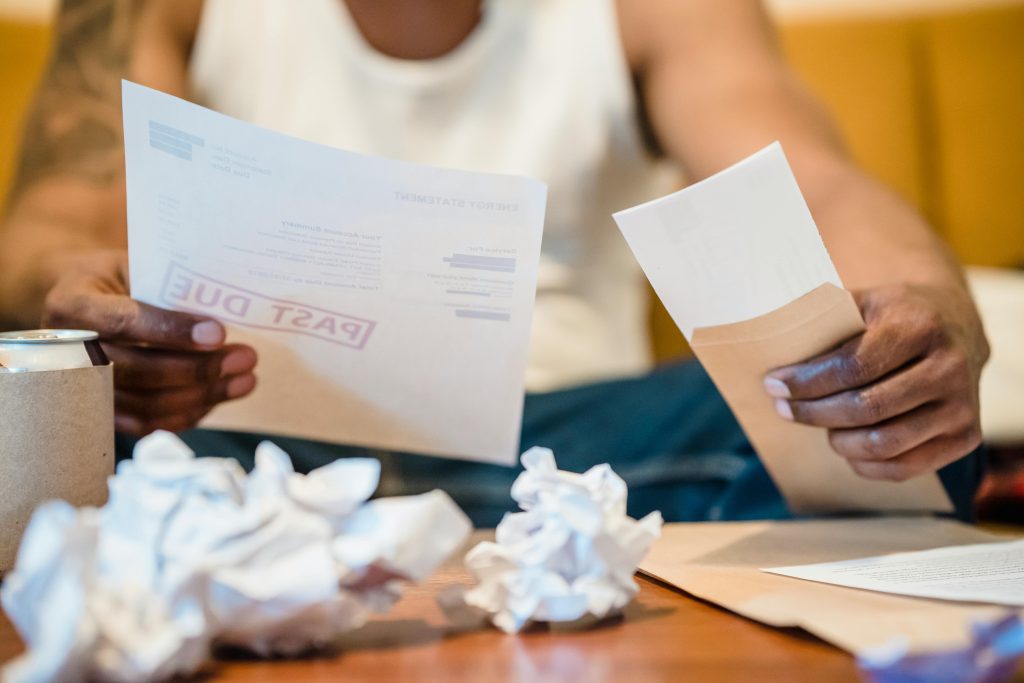

Cons

- High Interest Rates: As with many short-term loans, interest rates can be significantly higher than traditional loans.

- Risk of Vehicle Repossession: Failure to repay the loan can result in the loss of the vehicle.

- Limited Transparency: Specific loan terms and rates are not disclosed upfront and vary by lender.

Customer Feedback

Customer experiences with 1800LoanStore are varied:

- Positive Reviews: Some customers appreciate the quick and easy application process and the ability to receive funds rapidly.

Legal Aspects and Regulations

1800LoanStore operates as a loan-matching service, connecting borrowers directly with potential lenders. Since they are not a direct lender, they do not make credit decisions. Borrowers will enter into a loan agreement with the matched lender, not with 1800LoanStore. It’s important to review the lender’s terms and conditions thoroughly before moving forward.

Final Thoughts

1800LoanStore provides a fast and convenient solution for individuals who need immediate cash, particularly those with credit challenges that make traditional loans difficult to obtain. However, borrowers should weigh the benefits against the high-interest rates and the potential risk of vehicle repossession.

As with any financial decision, borrowers must evaluate their ability to repay the loan and explore all available alternatives before committing.

A Friendly Alternative: Ready Payday Loans

If you’re looking for a more affordable and flexible option, I invite you to consider Ready Payday Loans. At Ready Payday Loans, we focus on fast, secure loans with transparent terms and competitive rates. We care about helping you get the money you need without getting stuck in a cycle of debt.

We work with a wide network of lenders to match you with the best possible offer. Whether you need a small loan or just want more flexible repayment, we’re here to help. Feel free to visit Ready Payday Loans to learn more.

Thanks for reading my review, and stay financially smart!

— Randy Murrie