Marketloans Review

Hi, I’m Randy Murrie from Ready Payday Loans. If you’re looking into getting a loan online, chances are you’ve come across Marketloans. They’re one of the many companies in the short-term lending space offering access to payday loans, personal loans, and other fast-cash solutions. But what exactly do they offer, and how do they support borrowers in need?

In this review, I’ll share my thoughts on Marketloans, break down their loan services, and help you decide whether they’re a good option for your financial needs. I’ve taken a deep dive into what they offer, how they work, and how you can navigate their platform—all explained in a way that’s simple and easy to understand.l lending.

What is Marketloans?

Marketloans is a loan connection service. It isn’t a direct lender, but instead acts as a bridge between borrowers and a large network of lenders. That means when you fill out an application on their website, they connect you with lenders who may be able to offer a loan that fits your needs.

Key Features:

- Loan amounts from $100 to $35,000

- One online application connects you to multiple lenders

- No fees to use the service

- Access to payday, personal, and installment loans

- Options available for individuals with less-than-perfect credit

Loan Types Offered by Marketloans

One thing I appreciate is that Marketloans gives borrowers access to different types of loans through their lender network. This flexibility helps people find the right fit based on their situation.

Payday Loans

Payday loans are designed to cover small, urgent expenses and are typically repaid by your next paycheck.

- Loan amounts: $100 to $1,000

- Repayment: Usually 14 to 30 days

- Interest Rates: Varies by lender, often reflecting the fast access to cash

Personal Loans

These loans can be used for just about anything—medical bills, emergencies, home repairs, or even consolidating debt.

- Loan amounts: $1,000 to $35,000

- Repayment: 6 to 60 months

- Interest Rates: Typically ranges from 5.99% to 35.99%

Installment Loans

Installment loans are a flexible way to borrow a lump sum and repay it over time with a consistent monthly payment.

- Loan amounts: $500 to $5,000

- Repayment: 3 to 24 months

- Interest Rates: Depends on the lender’s terms

How Marketloans Work?

Here’s how the process works when you use Marketloans:

- Apply Online: Start by completing a short application form.

- Get Matched: Your application is sent to a network of trusted lenders.

- Review Offers: You may receive one or more loan offers to compare.

- Select Your Loan: Choose the offer that works best for you and finalize the terms directly with the lender.

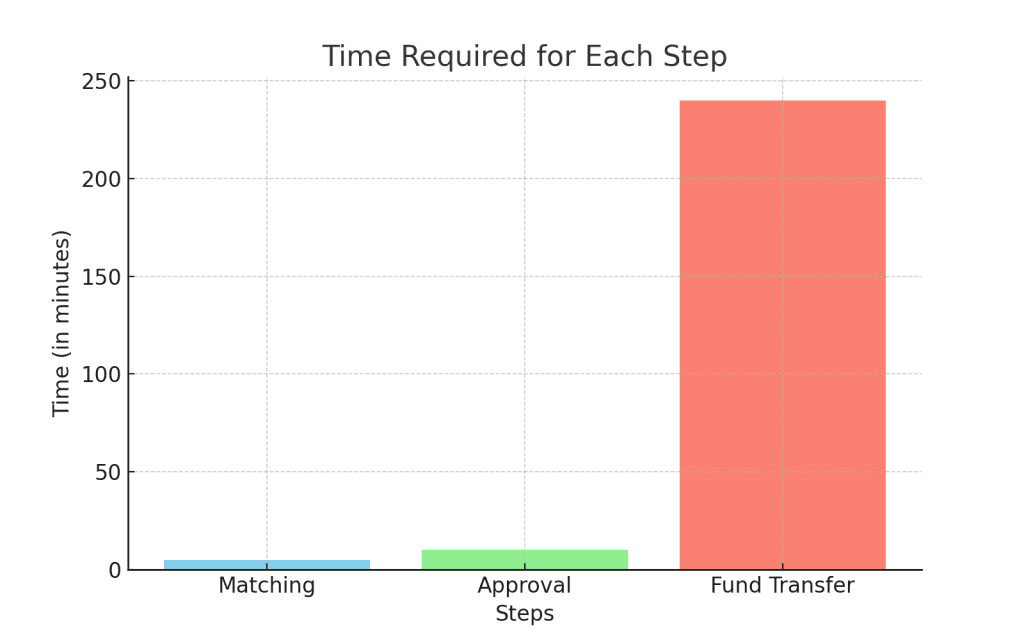

Chart: Typical Loan Process Timeline

| Step | Time Required |

| Application | 5 minutes |

| Matching | Instant to 10 min |

| Approval | Same day |

| Fund Transfer | 1 to 2 business days |

Requirements to Apply Marketloans

To apply for a loan through Marketloans, borrowers typically need:

- To be at least 18 years old

- A valid checking account

- Proof of income

- A Social Security number

Even applicants with less-than-stellar credit may be matched with lending options.

What Makes Marketloans Stand Out?

Several aspects of Marketloans caught my attention as useful features:

- Their site is designed for user-friendliness and quick results

- Their platform simplifies the loan comparison process

- They offer access to multiple lenders with just one form

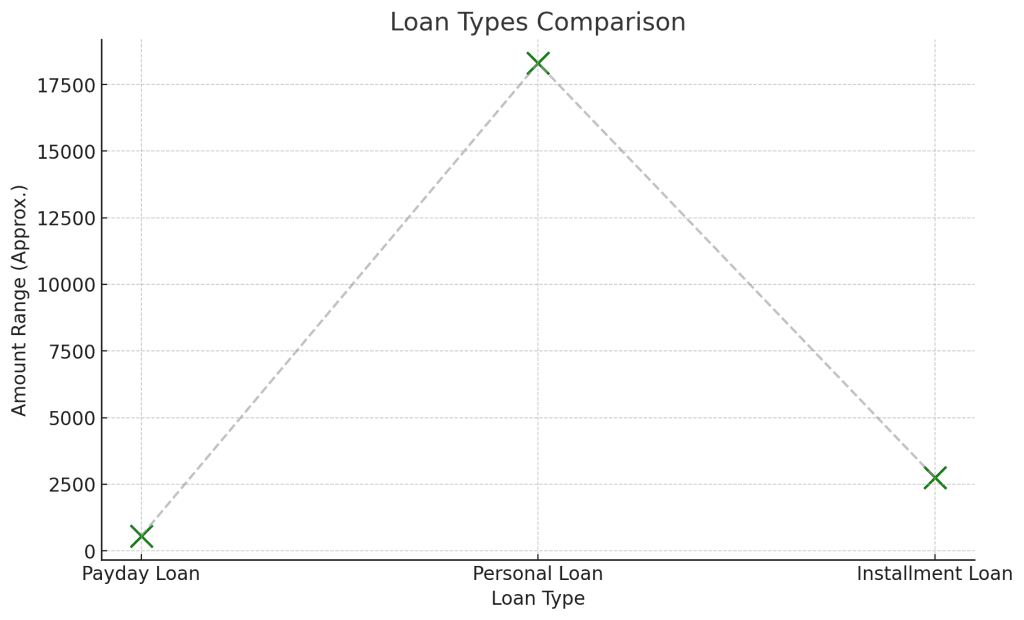

Chart: Loan Types and Typical Ranges

| Loan Type | Amount Range | Typical Repayment Period |

| Payday Loan | $100 – $1,000 | 14 – 30 days |

| Personal Loan | $1,000 – $35,000 | 6 – 60 months |

| Installment Loan | $500 – $5,000 | 3 – 24 months |

Is Marketloans Safe to Use?

Marketloans uses encryption and secure servers to help keep user data protected. Since it’s a loan marketplace, your application details may be shared with several potential lenders, allowing for competitive loan matching.

Real-Life Feedback

Many customers have shared positive experiences using Marketloans, particularly highlighting the simplicity of the application and the speed of getting connected with a lender.

“The site was easy to use, and I got several loan options to choose from. It helped me compare without filling out a bunch of forms.” – Tyler W.

“I was able to get a small personal loan within a day. The process was much easier than I expected.” – Maria G.

Who Might Benefit From Marketloans?

If you’re exploring quick loan options and want to compare several offers with one application, Marketloans offers a convenient pathway. Their service is ideal for:

- People with less-than-perfect credit

- Borrowers looking for payday or personal loans

- Those who value convenience and speed

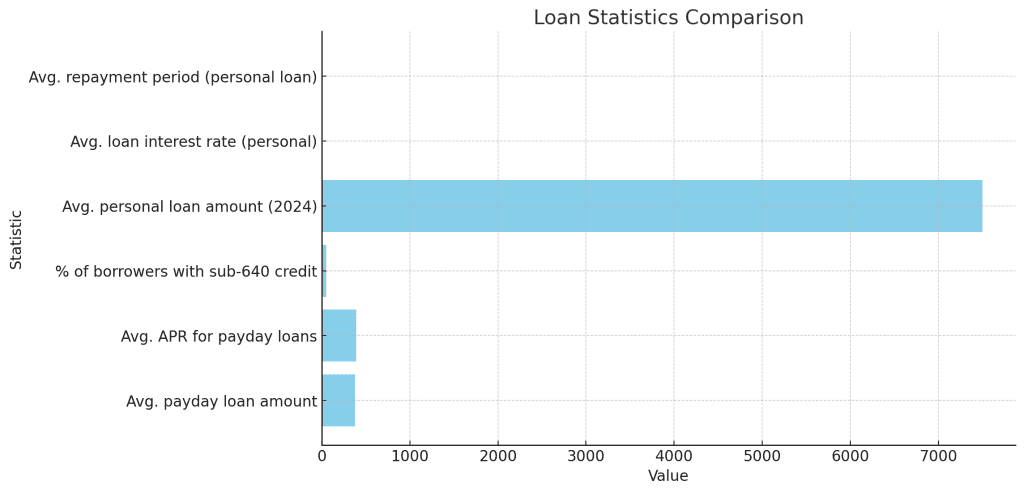

Loan Industry Snapshot

Here’s a quick look at some U.S. loan industry statistics to help put things into perspective:

Chart: 2024 Loan Industry Snapshot

| Statistic | Value |

| Avg. payday loan amount | $375 |

| Avg. APR for payday loans | 391% |

| % of borrowers with sub-640 credit | 53% |

| Avg. personal loan amount (2024) | $7,500 |

| Avg. loan interest rate (personal) | 12.26% |

| Avg. repayment period (personal loan) | 3 – 5 years |

Source: CFPB, LendingTree, Experian, Bankrate

Final Thoughts

In my experience, Marketloans offers a streamlined way to connect with a variety of lenders and explore loan options tailored to your unique situation. Their ability to serve people with varying credit profiles and the convenience of applying online make it a practical choice for many borrowers.

As always, read all loan terms carefully, understand the repayment requirements, and choose the loan that makes the most sense for your financial needs.

Ready Payday Loans: A Smart Alternative

If you’re looking for a lending option that’s transparent, fast, and tailored to your needs, I’d also recommend checking out Ready Payday Loans. We offer a customer-first approach with clear loan terms and a focus on helping you make smart financial decisions. While Marketloans connects you with many lenders, at Ready Payday Loans, we keep it personal and straightforward.

We’re here to help you get through life’s surprises—with less stress and more support.